14+ tax proration calculator

Annual property tax amount. Figures usually vary from actual closing costs.

Real Estate Math Free Practice Test 1 No 3 Tax Proration Problem Youtube

Ohio Seller Netsheet Calculator.

. Iowa Tax Proration Calculator. One mill is the same as 1 of tax for each 1000 in assessed worth. Iowa Tax Proration Calculator Todays date.

The Prorated rent for them in this example then would be 64008. Proportion Calculation - X sellers of days total amount tax 365 days. This data will be used to.

The Tax Proration Calculator - Calculates the property tax owed at the closing of a real estate transaction. November 2021 Pay 2022 Second Half Taxes Paid. You then multiply the daily rent.

This tool is used to determine whether the buyer or the seller is owed tax money. Property Tax Proration Calculator. Pro Rata Short Rate Calculator.

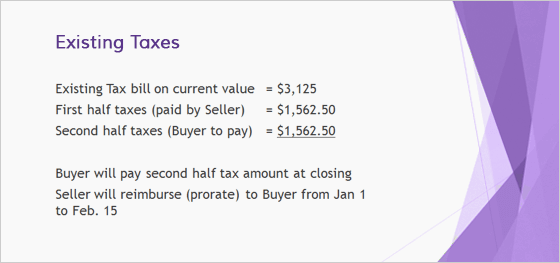

The tax proration is an allocation of the property taxes between the Seller and Purchaser that is determined by their contract. May 2021 Pay 2022 First Half Taxes Paid. 4000 X 105 4200.

Although Vertafore has made every effort to insure the accuracy of the calculator Vertafore. Floor area ratio calculator. In order to calculate the prorated rent amount you must take the total rent due divide it by the number of days in the month to determine a daily rent amount.

To find the amount for 2 nd. 30 7 1 move in day 24. Be careful making representations to your Seller.

If you wish to prorate over a period not. We then estimate the 2015 full year tax bill by simply multiplying the 2014 bill with 105. If the monthly rent is 1000 to calculate the prorated rent amount you would enter 1000 for the monthly rent December as the move-in month and the 17th for the move-in day.

This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your. Proration is inclusive of both specified dates. If the tenant will not move into the property until the 16 th of the month he or she will only be required to pay 15 days rental.

800 30 2667. Short Proration is calculated by multiplying the daily tax rate from the beginning of the current cycle to the present date. So a closing on August 15th would be prorated from July 1 to.

Property tax and proration calculators. As such the daily rate is 2333. Annual property tax amount.

30 15 days that the tenant will. How A lot Is Property Tax. In this contract the amount is 105.

Enter the General Information. It is not required but it is customary. Prorate a specified amount over a specified portion of the calendar year.

Heat of fusion calculator.

Part Ii Exemptions The Individual Shared Responsibility Payment November 4 Ppt Download

Netsheet Calculator Kidwell Cunningham Ltd

Sec Filing Avery Dennison Corporation

Netsheet Calculator Kidwell Cunningham Ltd

Document

How Does Tax Proration Work At A Real Estate Closing Lauren Jackson Law

Ex 99 1

Prorating Real Estate Taxes In Michigan

Document

How To Calculate Property Tax Prorations Tsre Tampa School Of Real Estate

Argos Therapeutics Annual Report

Part Ii Exemptions The Individual Shared Responsibility Payment November 4 Ppt Download

Property Tax Proration Va Guidelines On Va Home Loans

Cv Escrow How Property Tax Prorations Work In Escrow

Tax Proration Calculator Delta County Michigan

How To Prorate Real Estate Taxes

Basics Of Property Taxes Mortgagemark Com